Please refer to important disclosures at the end of this report

1

1

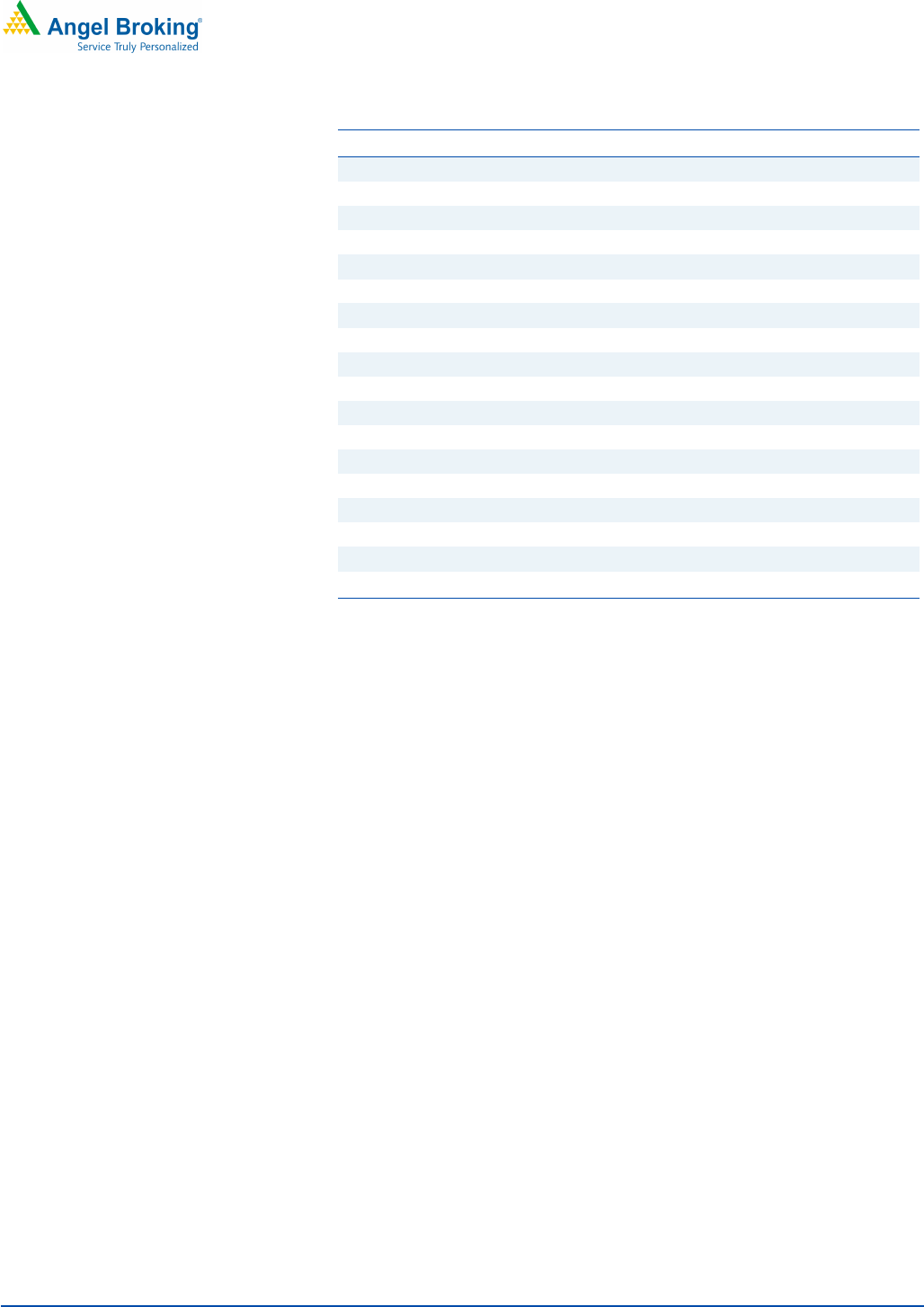

(` cr)

4QFY20

4QFY19

%

yoy

3QFY20

% qoq

Revenue

6,256

5,062

23.6

6,809

(8.1)

EBITDA

417

372

12.1

597

(30.1)

OPM (%)

6.7

7.4

(68bp)

8.8

(209bp)

Reported PAT

271

192

41.6

384

(29.4)

Source: Company, Angel Research

For 4QFY2020, Avenue Supermarts Ltd (ASL) posted mixed results. On the top-line

front result was in-line, however EBITDA was below our estimates. Consolidated

revenue grew by ~24% yoy; reported operating margins contracted by 68bps yoy.

On the bottom-line front, ASL reported PAT growth of ~42% yoy due to lower

taxes.

Top-line grew ~24%: During the quarter, ASL’s top-line grew by ~24% yoy to

`6,256r on back of stores expansion and healthy growth in existing stores.

However, in the month of March 2020 it grew by just ~11% vs. March 2019 due

to the effect of lockdown effect in the last 9 days of March. Currently, the company

is operating more than 50% of stores. Further, ASL has also started selling non-

essential items in ~35% of the stores. Some of ASL stores which are functioning on

a 24-hour basis for a very long time now have seen revenue trending closer to pre-

Covid-19 levels despite not selling non-essentials and having restricted footfalls.

Going forward, we expect the company to bounce back gradually to pre-Covid-19

levels.

PAT growth remains strong: On the operating front, the company reported margin

contraction, down 68bps yoy mainly due to ban of non-essentials items (in month

of March 2020), which has high margin and increase in staff cost. On the bottom-

line front, ASL reported PAT growth of ~42% yoy to `271cr on the back of lower

taxes.

Outlook and Valuation: We forecast ASL to report healthy top-line CAGR of ~19%

to `33,730cr over FY2019-21E on the back of strong store addition every year and

higher footfall as ASL offers significant discount compared to e-commerce, Modern

trade & General trade. On the bottom-line front (reported PAT), we estimate ~26%

CAGR to `1,825cr due to strong revenue and gradual improvement in operating

margin. Thus, we maintain BUY on the stock with Target Price of `2,564.

Key Financials

Y/E March (` cr)

FY2019 FY2020

FY2021E FY2022E

Net sales 20,005 24,870 27,781 33,730

% chg 33.1 24.3 11.7 21.4

Adj. Net profit 902 1,301 1,419 1,825

% chg 11.9 44.2 9.1 28.6

EBITDA margin (%) 8.2 8.6 8.4 8.8

EPS (`) 13.9 20.1 21.9 28.2

P/E (x) 164.4 114.0 104.5 81.3

P/BV (x) 26.5 21.5 17.9 14.6

RoE (%) 16.2 18.9 17.1 18.0

RoCE (%) 22.6 23.4 21.4 22.8

EV/Sales (x) 7.4 6.0 5.3 4.4

EV/EBITDA (x)

91.1

69.9

63.7

50.3

Source: Company, Angel Research

BUY

CMP `2,220

Target Price `2,564

Investment Period 12 months

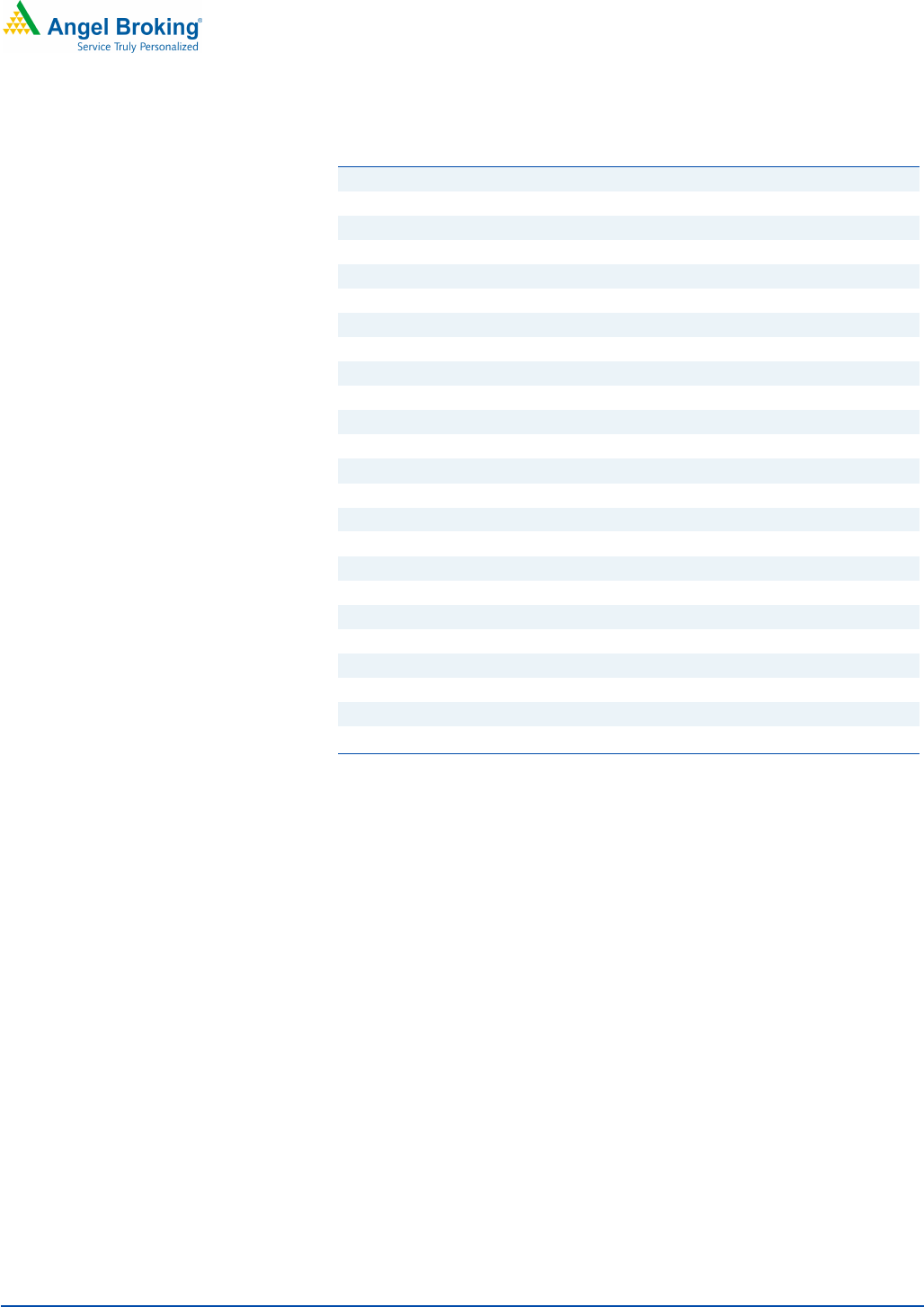

Stock Info

Sector Retail

Market Cap (` cr) 1,48,366

Net Debt (` cr)

476

Beta 0.7

52 Week High / Low 2,559/1,282

Avg. Daily Volume 25,242

Face Value (`) 10

BSE Sensex 30,609

Nifty 9,029

Reuters Code AVEU.BO

Bloomberg Code DMART.IN

Shareholding Pattern (%)

Promoters

75.0

MF / Banks / Indian

6.6

FII / NRIs / OCBs 9.7

Indian Public/Others

8.7

Abs.(%) 3m 1yr 3yr

Sensex

(24.0)

(21.6) 0.3

ASL (2.4) 84.9 233.0

Historical share price chart

Source: Company, Angel Research

Amarjeet S Maurya

022-40003600 Ext: 6831

amarjeet.maurya@angelbroking.com

Avenue Supermarts

Performance Update

0

500

1000

1500

2000

2500

3000

May-17

Aug-17

Nov-17

Feb-18

May-18

Aug-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

4QFY20 Result Update | Retail

May 27, 2020

Avenue Supermarts | 4QFY2020 Result Update

May 27, 2020

2

4QFY20 Performance

Y/E March (` cr)

4QFY20

4QFY19

% yoy

3QFY19

% qoq

FY2020

FY2019

% chg

Net Sales

6,256

5,062

23.6

6,809

(8.1)

24870.2 20004.5

24.3

Consumption of RM 5406

4,319

25.2

5766

(6.2)

21,103

17,001

24.1

(% of Sales)

86.4

85.3

84.7

84.9

85.0

Staff Costs

126

92

37.2

118

6.5

456

355

28.3

(% of Sales)

2.0

1.8

1.7

1.8

1.8

Other Expenses

307

278

10.3

328

(6.5)

1183 1015

16.5

(% of Sales)

4.9

5.5

4.8

4.8

5.1

Total Expenditure

5,839

4,689

24.5

6,212

(6.0)

22,742

18,371

23.8

Operating Profit

417

372

12.1

597

(30.1)

2,128

1,633

30.3

OPM

6.7

7.4

8.8

8.6

8.2

Interest

14

12

19.3

18

(18.4)

69

47

46.4

Depreciation

105

66

58.8

95

9.8

374

212

76.2

Other Income

35

13

163.2

6

474.1

60.0

48.4

24.1

PBT (excl. Ext Items)

333

308

8.3

490

(32.0)

1,745

1,422

22.7

Ext (Income)/Expense -

-

-

-

-

PBT (incl. Ext Items)

333

308

8.3

490

(32.0)

1,745

1,422

22.7

(% of Sales)

5.3

6.1

7.2

7.0

7.1

Provision for Taxation

62

116

(46.6)

106

(41.5)

444

519

(14.6)

(% of PBT)

18.6

37.7

21.6

25.4

36.5

Reported PAT

271

192

41.6

384

(29.4)

1,301

902

44.2

PATM

4.3

3.8

5.6

5.2

4.5

Minority Interest After NP (0)

(0)

(0)

(0)

(0)

Reported PAT

271

192

41.6

384

(29.4)

1,301

903

44.2

Source: Company, Angel Research

Avenue Supermarts | 4QFY2020 Result Update

May 27, 2020

3

Outlook and Valuation

We forecast ASL to report healthy top-line CAGR of ~19% to `33,730cr over

FY2019-21E on the back of strong store addition every year and higher footfall as

ASL offers significant discount compared to e-commerce, Modern trade & General

trade. On the bottom-line front (reported PAT), we estimate ~26% CAGR to

`1,825cr due to strong revenue and gradual improvement in operating margin.

Thus, we maintain BUY on the stock with Target Price of `2,564.

Downside risks to our estimates

ASL is unable to open new stores due to Covid-19, which could impact negatively

earing of the company

Company Background

Avenue Supermarts Limited is a Mumbai-based company, which owns and

operates D-Mart stores. D-Mart is a national supermarket chain with a focus on

value retailing. The Company offers a wide range of products with a focus on

Foods, Non-Foods (FMCG) and General Merchandise & Apparel product

categories. The Company offers its products under various categories, such as

grocery and staples, daily essentials, processed foods and beverages, snacks,

dairy and frozen, home and personal care, bed and bath, crockery, toys and

games, apparel for kids, ladies and men. The Company opened its first store in

Mumbai, Maharashtra in 2002. As of March 31, 2020 the Company hadm214

stores with Retail Business Area of 7.8 million sq. ft. across Maharashtra, Gujarat,

Daman, Andhra Pradesh, Karnataka, Telangana, Tamil Nadu, Madhya Pradesh,

Rajasthan, NCR, Chhattisgarh and Punjab.

Avenue Supermarts | 4QFY2020 Result Update

May 27, 2020

4

Y/E March (` cr)

FY2018

FY2019 FY2020 FY2021E FY2022E

Net Sales

15,033

20,005

24,870

27,781

33,730

% chg

26.4

33.1 24.3 11.7 21.4

Total Expenditure

13,680

18,371

22,742

25,447

30,779

Raw Material

12,636

17,001

21,103

23,669

28,772

Personnel

283

355

456

556

658

Others Expenses

762

1,015

1,183

1,222

1,349

EBITDA

1,353

1,633

2,128

2,334

2,951

% chg

39.7

20.7 30.3 9.6 26.5

(% of Net Sales)

9.0

8.2 8.6 8.4 8.8

Depreciation& Amortization

159

212

374

429

505

EBIT

1,194

1,421

1,754

1,905

2,447

% chg

42.0

19.0 23.4 8.6 28.5

(% of Net Sales)

7.9

7.1 7.1 6.9 7.3

Interest & other Charges 6

0

47

69

58

58

Other Income

88

48

60

50

50

(% of PBT)

7.2

3.4 3.4 2.6 2.1

Recurring PBT

1,222

1,422

1,745

1,896

2,439

% chg

63.6

16.4 22.7 8.7 28.6

Tax

416

519

444

477

614

(% of PBT)

34.0

36.5 25.4 25.2 25.2

PAT (reported)

806

902

1,301

1,419

1,825

Extraordinary Items

-

-

-

-

-

ADJ. PAT

806

902

1,301

1,419

1,825

% chg

68.4

11.9 44.2 9.1 28.6

(% of Net Sales)

5.4

4.5 5.2 5.1 5.4

Basic EPS (`)

12.4

13.9 20.1 21.9 28.2

Fully Diluted EPS (`)

12.4

13.9 20.1 21.9 28.2

% chg

68.4

11.9 44.2 9.1 28.6

Avenue Supermarts | 4QFY2020 Result Update

May 27, 2020

5

Balance Sheet

Y/E March (` cr)

FY2018

FY2019

FY2020E

FY2021E

FY2022E

SOURCES OF FUNDS

Equity Share Capital

624

624

624

624

624

Reserves& Surplus

4,045

4,963

6,264

7,684

9,509

Shareholders Funds

4,669

5,587

6,889

8,308

10,133

Total Loans

439

700

600

600

600

Deferred Tax Liability

57

68

68

68

68

Total Liabilities

5,166

6,356

7,557

8,976

10,801

APPLICATION OF FUNDS

Gross Block

3,801

5,010

6,210

7,410

8,610

Less: Acc. Depreciation

401

609

984

1,413

1,917

Net Block

3,400

4,400

5,22

6

5,997

6,692

Capital Work-in-Progress

147

377

377

377

377

Investments

68

17

17

17

17

Current Assets

2,033

2,212

2,761

3,481

4,777

Inventories

1,163

1,609

2,112

2,436

3,142

Sundry Debtors

34

64

68

76

92

Cash

560

219

108

358

531

Loans & Advances

147

174

249

361

675

Other Assets

129

146

224

250

337

Current liabilities

494

654

828

900

1,067

Net Current Assets

1,539

1,557

1,933

2,581

3,710

Deferred Tax Asset

12

5

5

5

5

Mis. Exp. not written off

-

-

-

-

-

Total Assets

5,166

6,356

7,557

8,976

10,801

Avenue Supermarts | 4QFY2020 Result Update

May 27, 2020

6

Cash flow Statement

Y/E March (` cr)

FY2018

FY2019

FY2020

E

FY2021E

FY2022E

Profit before tax

1204

1422

1745

1896

2439

Depreciation

159

212

374

429

505

Change in Working Capital

(243)

(351)

(486)

(398)

(957)

Interest / Dividend (Net)

16

24

69

58

58

Direct taxes paid

(403)

(502)

(444)

(477)

(614)

Others

(3)

1

0

0

0

Cash Flow from Operations

730

807

1258

1509

1431

(Inc.)/ Dec. in Fixed Assets

(909)

(1408)

(1200)

(1200)

(1200)

(Inc.)/ Dec. in Investments

1372

450

0

0

0

Cash Flow from Investing

464

(958)

(1200)

(1200)

(1200)

Issue of Equity

0

0

0

0

0

Inc./(Dec.) in loans

(1079)

260

(100)

0

0

Dividend Paid (Incl. Tax)

0

0

0

0

0

Interest / Dividend (Net)

(1439)

(450)

(69)

(58)

(58)

Cash Flow from Financing

(2518)

(190)

(169)

(58)

(58)

Inc./(Dec.) in Cash

(1324)

(341)

(111)

250

173

Opening Cash balances

1884

560

219

108

358

Closing Cash balances

560

219

108

358

531

Avenue Supermarts | 4QFY2020 Result Update

May 27, 2020

7

Key Ratios

Y/E March

FY2018 FY2019

FY2020E

FY2021E

FY2022E

Valuation Ratio (x)

P/E (on FDEPS)

184.0

164.4

114.0

104.5

81.3

P/CEPS

153.7

133.0

88.5

80.3

63.7

P/BV 31.8 26.5

21.5

17.9

14.6

Dividend yield (%) 0.0 0.0

0.0

0.0 0.0

EV/Sales 9.9 7.4

6.0

5.3 4.4

EV/EBITDA

109.5

91.1 69.

9

63.7

50.3

EV / Total Assets 28.7 23.4

19.7

16.6

13.7

Per Share Data (`)

EPS (Basic) 12.4 13.9

20.1

21.9

28.2

EPS (fully diluted) 12.4 13.9

20.1

21.9

28.2

Cash EPS 14.9 17.2

25.9

28.5

36.0

DPS 0.0 0.0

0.0

0.0 0.0

Book Value 72.1 86.3

106.3

128

.3

156.4

Returns (%)

ROCE 23.4 22.6

23.4

21.4

22.8

Angel ROIC (Pre-tax) 26.6 23.5

23.8

22.3

24.0

ROE 17.3 16.2

18.9

17.1

18.0

Turnover ratios (x)

Asset Turnover (Gross Block) 4.0 4.0

4.0

3.7 3.9

Inventory / Sales (days) 28 29

31

32

34

Receivables (days) 1 1

1

1 1

Payables (days) 8 10

10

9 8

Working capital cycle (ex-

cash) (days)

21 21

22

24

27

Source: Company, Angel Research

Avenue Supermarts | 4QFY2020 Result Update

May 27, 2020

8

Research Team Tel: 022

-

39357800 E

-

mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Ratings (Returns): Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Reduce (-5% to -15%) Sell (< -15%)

Disclosure of Interest Statement

Avenue Supermarts

1. Financial interest of research analyst or Angel or his Associate or his relative No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3. Served as an officer, director or employee of the company covered under Research No

4. Broking relationship with company covered under Research No